Proposing Qualified Annuities-RMD Calculation

When proposing an annuity in Cash Flow Decisions, you have the option to select if it’s qualified. If it is qualified, the amount rolled over is NOT taxed, but fully taxable on distribution. Required minimum distributions still apply to qualified rollovers. CFD assumes that the monthly payout from the qualified annuity is meeting the RMD amount. Any remaining amount in the qualified plan(s), that wasn’t rolled over to an annuity, is being calculated towards the RMD calculation. For more about CFD’s calculation assumptions, click here!

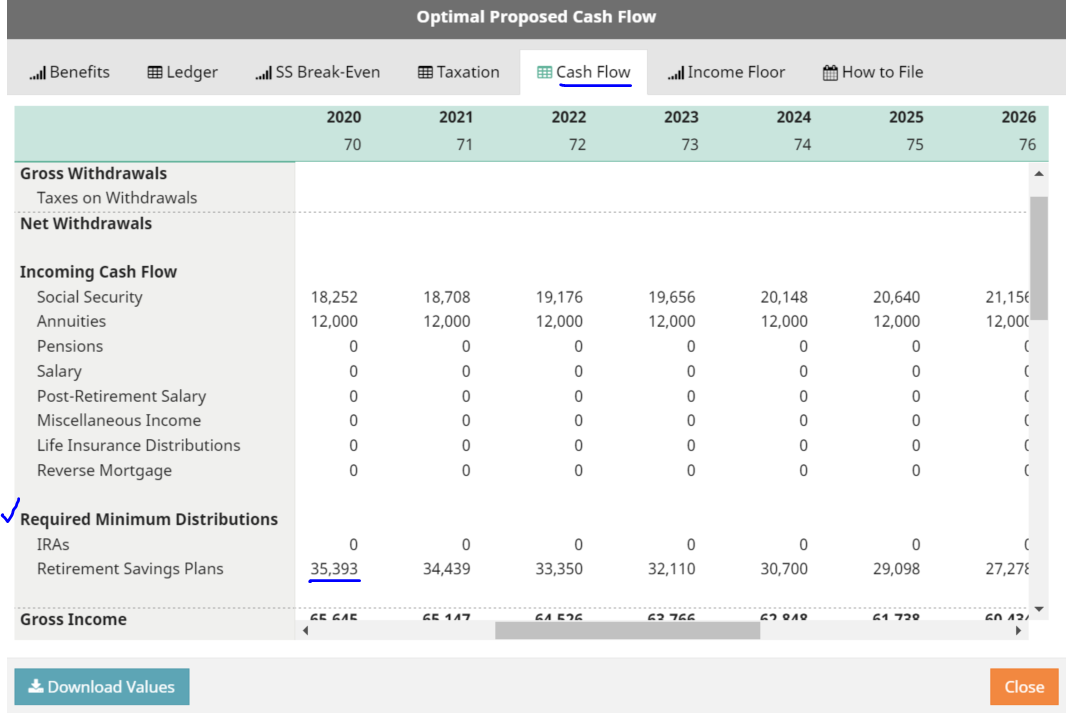

Here is where you propose annuities:

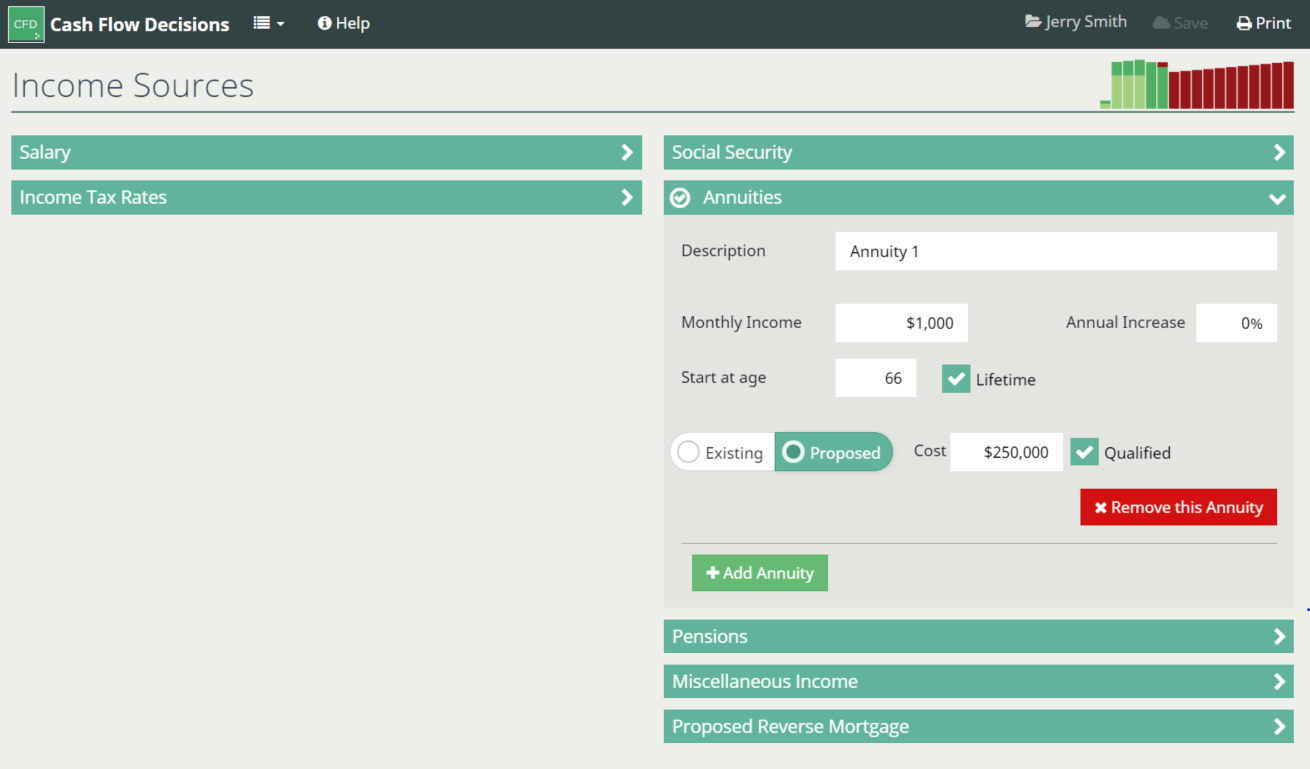

Make sure to utilize the ‘Cash Flow’ tab, which breaks all transactions down including RMD amounts: