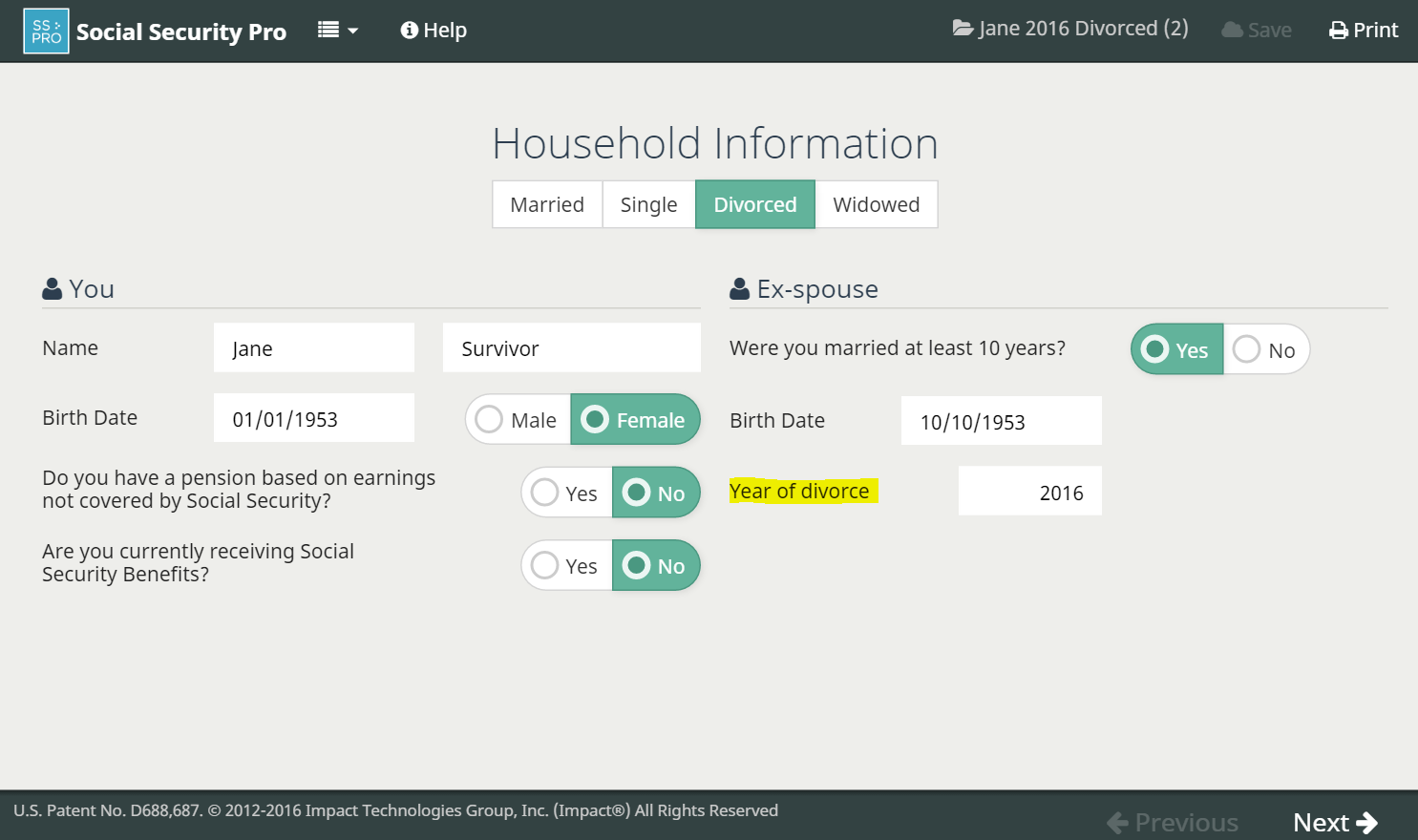

Is your client divorced and not remarried?

If you are divorced, but your marriage lasted 10 years or longer, you can receive benefits on your ex-spouse’s record (even if he or she has remarried) if:

- You are unmarried;

- You are age 62 or older;

- Your ex-spouse is entitled to Social Security retirement or disability benefits and

- *If ex-spouse has not filed for benefits but is eligible, the divorce needs to have taken place 2 or more years from today’s date in order for benefits to be available

- If there are multiple 10+ year marriages that have ended in divorce, and you are now single, you can choose which ex-spouse you’ll draw off of

*CFD and SSPro assumes the ex-spouse has not filed for benefits, so the 2 year ‘wait’ rule will always apply. If the ex-spouse has filed for benefits already, input a divorce year that is 2 or more years from the current year to allow for any spousal benefits to start immediately. SSE assumes ex-spouse has filed already, which means spousal benefits will be paid immediately.

For more information from the SSA: https://www.ssa.gov/planners/retire/divspouse.html