Proposing Life Insurance with Cash-Value Loan Distributions in CFD

Cash Flow Decisions (CFD) allows you to propose different types of life insurance products. Permanent insurance often has cash-value accumulation. If you’re planning on illustrating permanent insurance, and want to emphasize loan distributions from cash-value, that can easily be done in CFD.

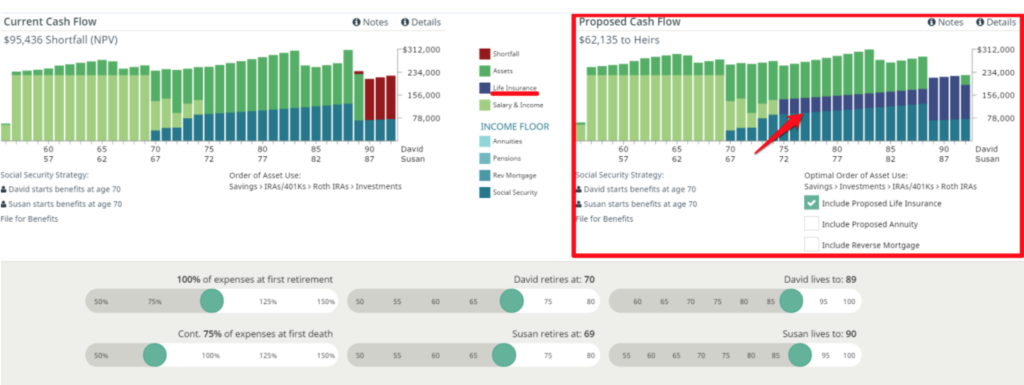

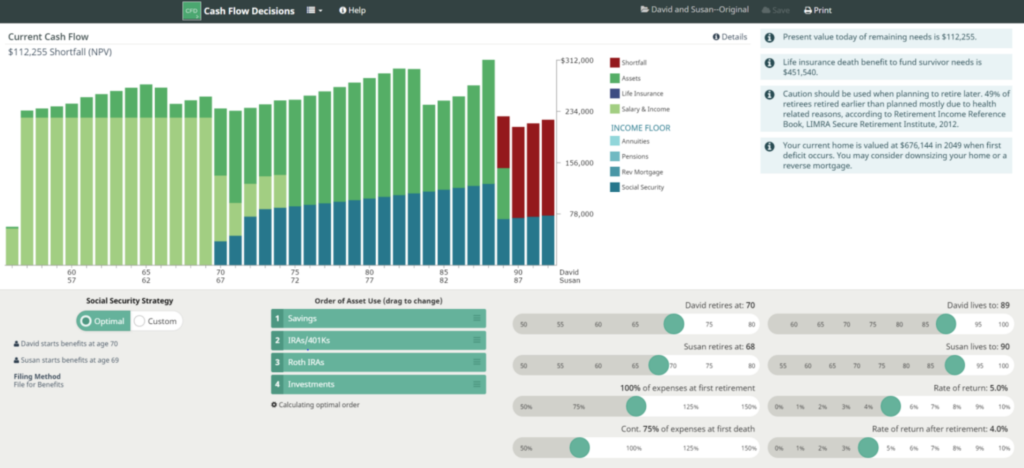

There’s a few ways to show the benefits of cash value type policies. Follow the steps below. You’re typically going to go through the program first to see ‘current’ results before proposing any type of product. The page below (we call this the playground page) will show you everything from shortfalls, surpluses, money coming in and money going out, tax payments, pretty much everything! Don’t forget the ‘Details’ tab up top to the right, where everything is broken down in finer detail. If you feel there is need for improvement, you can go back to propose life insurance (and/or annuities and reverse mortgage).

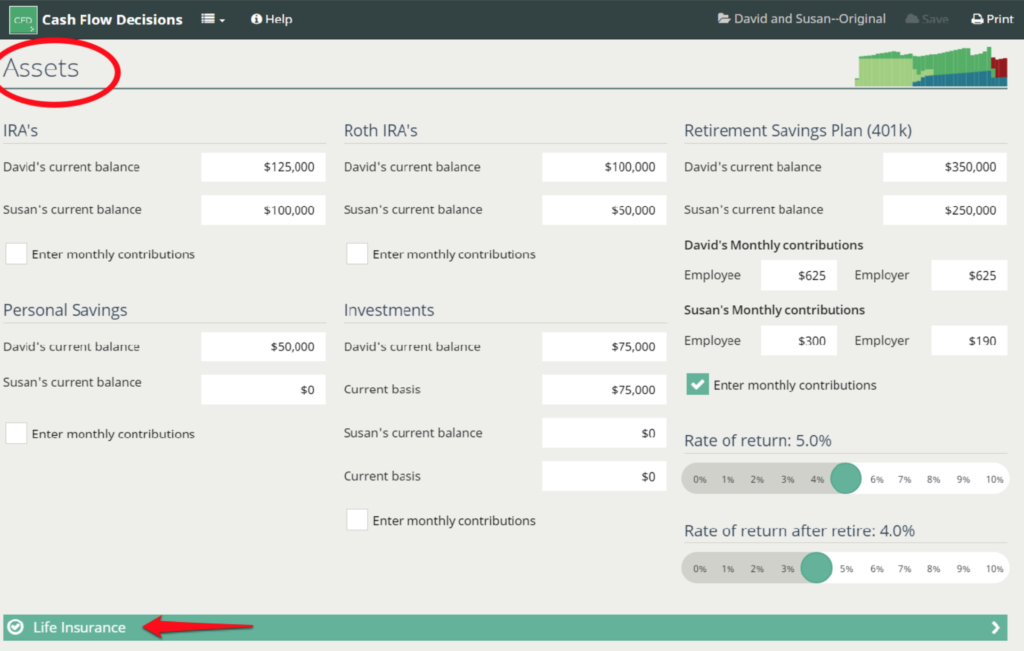

We consider life insurance as an asset. You’ll find the life insurance input section at the bottom of the ‘Asset’ screen.

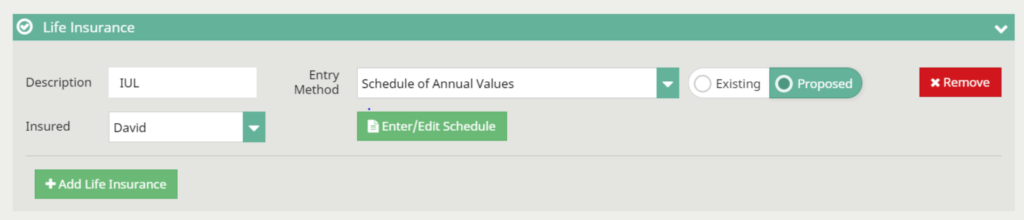

Once there, you’ll have the option to input Current or Proposed. Current should be selected to input existing life insurance policies. Make sure to select Proposed for inputting anything that is not currently in place so it can be directly compared to the current scenario side-by-side.

Besides choosing whether it’s an existing policy or proposed, add a policy description and choose the insured. You also have 3 different options to input the policy. You can simply enter a death benefit amount and premium. Or, you can Schedule of Annual Values (see below). Or, Load Illustration from a Link File. An XML file is required. The file needs to be saved locally to your computer first.

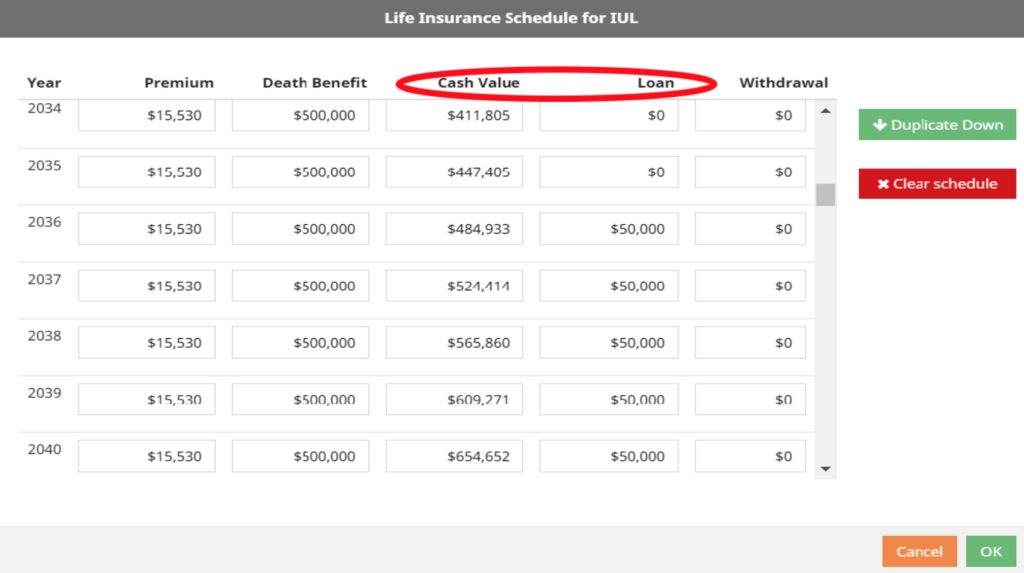

By selecting ‘Schedule of Annual Values’, you get the most flexibility. If values remain the same throughout the life of the policy/insured, take advantage of the ‘Duplicate Down’ feature.

The greatest thing about permanent insurance, besides a guaranteed death benefit, is the building of cash value. The cash value column shows the accumulation; it is not associated with any of the calculations. However, loans, withdrawals, premiums and the death benefit do show on the cash-flow and are calculated.

Whether you’re showing an ordinary life insurance policy, universal or variable, use the loan/withdrawal section to take advantage of the cash-value. Anything in the loan/withdrawal column will show as an incoming cash flow for that particular year.

Notice the dark blue below, that’s loan distributions getting used, the remainder of the policy is getting payed out after the husband passes away.