Calculation Guide: Social Security Pro

Input Required

Only a few input items are needed to provide a reasonable estimate of Social Security benefits.

Social Security Pro benefit calculations are based on user input of the estimated Social Security benefit amount at Full Retirement Age as found on a Social Security Benefit statement. If the starting age for benefits is not equal to FRA, the benefit amount is adjusted by formula for the years and months prior to or after FRA. Information on getting a Social Security Benefit Statement is found on the Social Security website at http://www.socialsecurity.gov/mystatement/.

Social Security Basics

Social Security Pro adjusts the benefit amounts based on formulas published by the Social Security Administration. For more details, see http://www.socialsecurity.gov/retire2/agereduction.htm.

All benefit estimates assume benefits start on the first of the month following the month the person attains the indicated start age. Full Retirement Age is 66 for persons whose year of birth is 1954 and earlier and 67 for those in 1960 and later.

If the start age is FRA or later, benefits will include delay credits of approximately 8% per year beyond FRA. (See http://www.socialsecurity.gov/retire2/delayret.htm.)

Social Security assumes that people born on the first of the month were born in the previous month. Also, for those individuals born on January 1, for Social Security purposes, they are assumed born in December of the prior year. For example, if someone has a January 1, 1958 birthday, Social Security assumes they were born in December of 1957.

In Social Security Pro, if the person’s birth year falls into the range 1955 to 1959, Social Security Pro uses an FRA of 66 plus the number of months indicated in the following table. For these individuals, a start age of 66 indicates a desire to use FRA.

| Birth Year | Full Retirement Age

for Retirement Benefits |

| 1955 | 66 years and 2 months |

| 1956 | 66 years and 4 months |

| 1957 | 66 years and 6 months |

| 1958 | 66 years and 8 months |

| 1959 | 66 years and 10 months |

For example, if a person was born in 1956, the start age for benefits is 62; the reduction is calculated for 4 years and 4 months or 26.67%. Delay credits are similarly adjusted for the number of months past FRA. For the person born in 1956, delay credits at age 70 would produce payments equal to 129.33% of the benefit at FRA.

Cost of Living Increases

Cost of Living for benefits Increases (COLA) use the input Social Security cost of living adjustment, applied annually to each year’s benefit amounts. The first increase is considered to occur at the start of year 2 and continue through the years calculated.

Evaluation of Total Benefits

The future value of the benefit income stream is calculated using the Rate of return/discount rate. The balance is initialized to 0 and each year annual compound interest is applied to the balance. Next, the total Social Security benefits are added to the balance to determine the future value at the end of a calculation year. Present value is the future value discounted to the current year.

The future value of the benefits as invested in the last year illustrated may be used to compare one set of calculations to another. The highest future value is considered the “best” age or strategy. If the Rate of return/discount rate is 0%, the future value of benefits is equal to the total benefits received over the years.

Other Assumptions

There are many other factors that may affect the amount of benefits you and your family receive. Social Security Pro does not consider these adjustments to benefits, such as: additional dependent benefits, reductions due to earnings limitations, credits for military service, increases for work record after FRA, and adjustments for participation in certain retirement plans.

Effects of Marital Status and Strategy on Benefits

Married (spouse is living) – A married person’s Social Security benefit is the greater of his or her own benefit or up to one-half of spouse’s benefit at spouse’s FRA. The additional amount is called the spousal benefit. The spousal benefit is the difference between the person’s own benefit at FRA and 50% of spouse’s benefit at FRA. If taken prior to FRA, the spousal benefit is reduced. The difference is then added to his or her own benefit if own benefit is smaller than one-half spouse’s benefit. The person’s own benefit is also reduced when receiving benefits prior to FRA. (See http://www.socialsecurity.gov/retire2/agereduction.htm.)

Multiple strategies are available:

- No special filing – The individual files for benefits and begins receiving payments at the indicated start age. File assumes or “deemed” you to have applied for all benefits, such as spousal benefits, for which you are eligible. Payments continue until “lives to” age.

- Restricted application – The individual files only for spousal benefits at the later of indicated start age or FRA. Spousal benefits continue until age 70, at which time Social Security will pay the greater of his or her benefit with delay credits or the spousal benefit. If the spouse has not filed for benefits, spousal benefit pays nothing. The individual’s own benefit is increased 8% for each year after FRA until benefits start. This claiming strategy is only available to individuals who were at least age 62 by the end of 2015. Only one person in the marriage can receive a Spousal benefit.

Single – Filing early or filing late are the only things which change benefits. Benefits will be adjusted by formula for early or delayed retirement.

Widowed or Survivor Benefits: The widowed person or surviving spouse will get the greater of his or her benefit OR the amount the deceased spouse was receiving when death occurred. The survivor benefit is the deceased’s full benefit amount, not one-half the deceased spouse’s benefit. If the spouse died before starting benefits prior to FRA, survivor gets the full FRA benefit as a survivor benefit. If death occurs before starting benefits and after FRA, delay credits are applied. Once the benefit amount is determined, reductions apply if surviving spouse files for benefits prior to FRA. Survivor benefits are available at age 60 or older, or for a parent with children under age 16. Reductions apply prior to FRA. (See http://ssa.gov/survivorplan/survivorchartred.htm.)

The Full Retirement Age for survivor benefits differs slightly from retirement FRA. It is age 66 for those born prior to 1957 increasing to 67 for those born in 1962 or later. Those born in 1957 through 1961 have an FRA as follows:

| Birth Year | Full Retirement Age

for Survivor Benefits |

| 1957 | 66 years and 2 months |

| 1958 | 66 years and 4 months |

| 1959 | 66 years and 6 months |

| 1960 | 66 years and 8 months |

| 1961 | 66 years and 10 months |

The widow or widower who has not yet applied for Social Security benefits may file a Restricted Application to potentially maximize benefits by taking survivor benefits and starting his or her own benefits with delay credits at age 70. Another option is to start your own retirement benefits early and then switch to survivor benefits at FRA.

Divorced (married 10 years or more to former spouse and not currently married): A divorced person may collect benefits on an ex-spouse’s record as if they were still married EXCEPT it doesn’t matter if or when ex-spouse starts benefits if they have been divorced more than 2 years. Benefits based on former spouse’s Social Security can start if ex-spouse has reached age 62. The spousal is calculated as if the couple were married, essentially one-half ex-spouse’s FRA benefit, and it is not reduced even if ex-spouse is younger than FRA. However, it is reduced if the divorced person starts spousal benefits prior to his or her own FRA. There are no delay credits available for divorced spousal benefits post-FRA.

If divorced less than 2 years, then benefits are not available to start until ex-spouse files for benefits. If ex-spouse is 60 years old or less, it will be 2+ years before ex-spouse can start benefits; if ex-spouse is already 62, spousal benefits are available to the divorced person.

A divorced person who was at least age 62 by the end of 2015 and has not yet applied for Social Security benefits may file a Restricted Application to potentially maximize benefits by taking spousal benefits starting at FRA and starting his or her own benefits with delay credits at age 70. A divorced person who born after 1954 will be ‘deemed’ to have applied for any ex-spousal benefit when he or she applies for their own benefit. File and Suspend makes no sense, it has the same effect as waiting to file. If a divorced person has more than one ex-spouse, the divorced person can use either one as long as the ex-spouse chosen meets the above requirements.

If divorced, married 10 years or more, and the prior spouse is deceased, select Widowed to estimate benefits. If married less than 10 years before divorce, there are no spousal or survivor benefits. Select Single to estimate benefits.

For further information on benefits for divorced spouses, see http://ssa.gov/retire2/yourdivspouse.htm and http://ssa.gov/retire2/divspouse.htm.

Additional Details

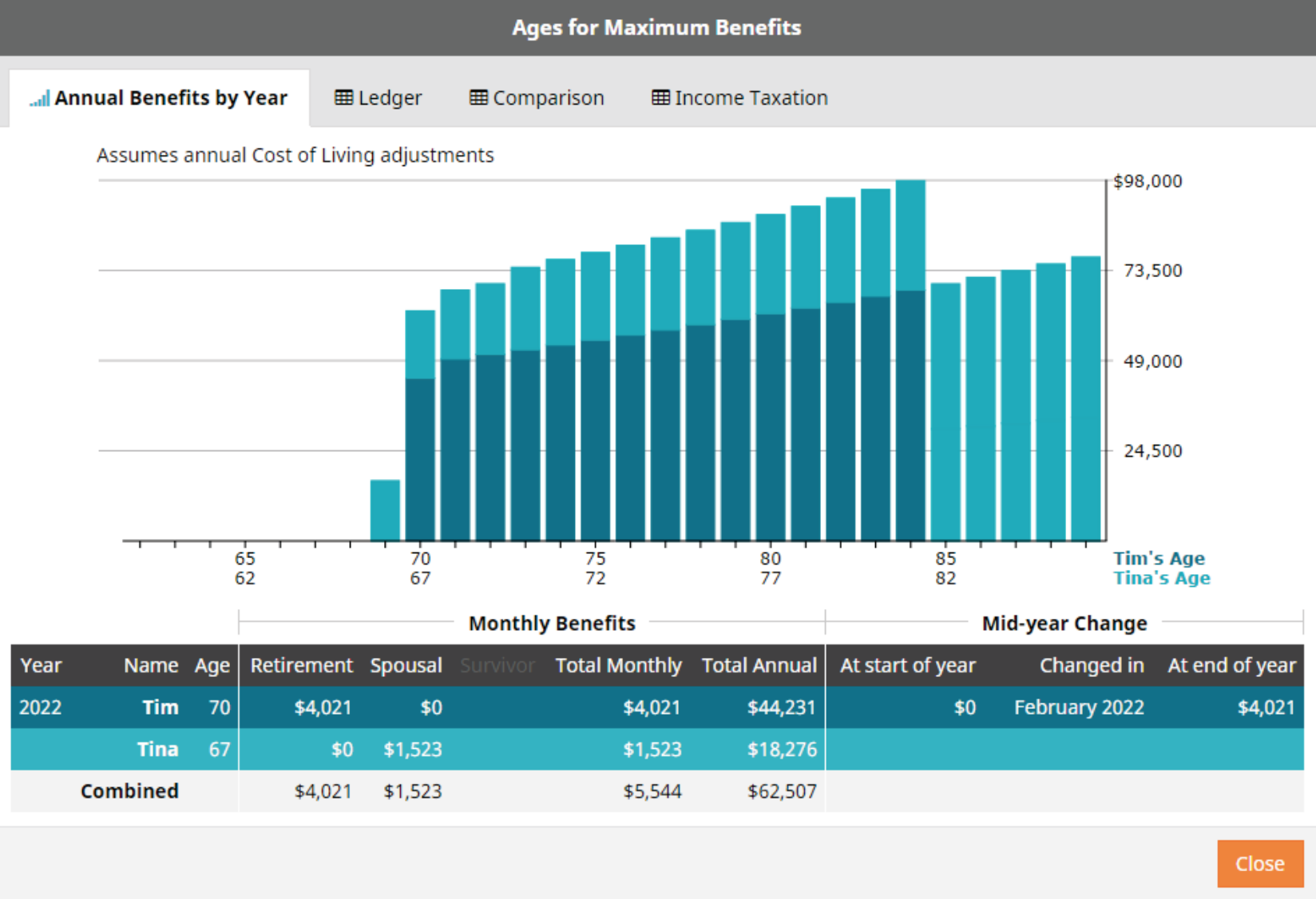

Additional Details window is accessible by clicking or tapping on the small graph to the right of Ages for Maximum Benefits or to the right of Alternative Ages. (See image) Four sets of information appear in the window based on the set of ages chosen. The heading shows which set of details is being shown. (See image below that shows details for Ages for Maximum Benefits.)

The initial graph shows “Annual Benefits by Year.” Click on a bar to display the values below the graph. The monthly values for the bar for ages 70/67 are shown in this example. Each client is represented by a different shade of blue. When a monthly amount changes during the year, the Mid-year Change is shown.

By clicking “Ledger,” the annual values are shown in a ledger form instead of a graph.

By clicking “Comparison,” the annual values and cumulative values are shown for each age. Up to four comparisons are made of the annual values and cumulative values: Maximum (indicated with a star on the screen), Alternative (indicated with a target on the screen), Earliest, and Latest.

By clicking “Income Taxation,” an estimate of the taxes on the Social Security benefits is shown. The tax is based on the effective income tax rate entered. This should represent the client’s income taxes actually paid as a percent of total income. Because of deductions and graduated tax rates, the effective rate is usually lower than the marginal rate or tax bracket. The “modified adjusted gross income” (MAGI) is an estimate of adjusted gross income plus certain tax-free income such as income from municipal bonds. Social Security benefits may be subject to income tax if income exceeds certain threshold levels. Additional input for Marginal Income Tax Rate and Modified Adjusted Gross Income allow a simple demonstration of how Social Security benefits may be taxed. Annual benefits and, if married, Spouse and Total Benefits are shown. Income tax is based on combined income, including Modified Adjusted Gross Income, exceeding $25,000, if single, and $34,000, if married. The formula is complex, and from 50-85% of the Social Security benefits each year may be subject to income taxes.

The amount subject to taxes is multiplied by the Marginal Income Tax Rate to produce the Income Tax column. The Total After Tax column is equal to Total minus Income Tax. (For further information on taxation of benefits, see http://ssa.gov/planners/taxes.htm.)

Other Calculation Assumptions

- Monthly benefits are assumed to start the month following eligibility. For example, if benefits begin at FRA 66 of June 15, the first monthly check would be received in July, so that only six monthly checks would be received that year.

- Rate of return/discount rate should be zero if all of the Social Security benefits are being used for living expenses. If the Social Security benefits will be saved, or used in lieu of using savings, then the client’s savings rate is best used. Future value of Social Security benefits and the present value of Social Security benefits use this rate. The label automatically says Cumulative benefits if zero is used for this rate.

Helpful Hint: When trying to understand a calculation, it is usually easier if Rate of return/discount rate and Cost-of-living Adjustment are set to zero. This makes the resulting values much easier to follow.