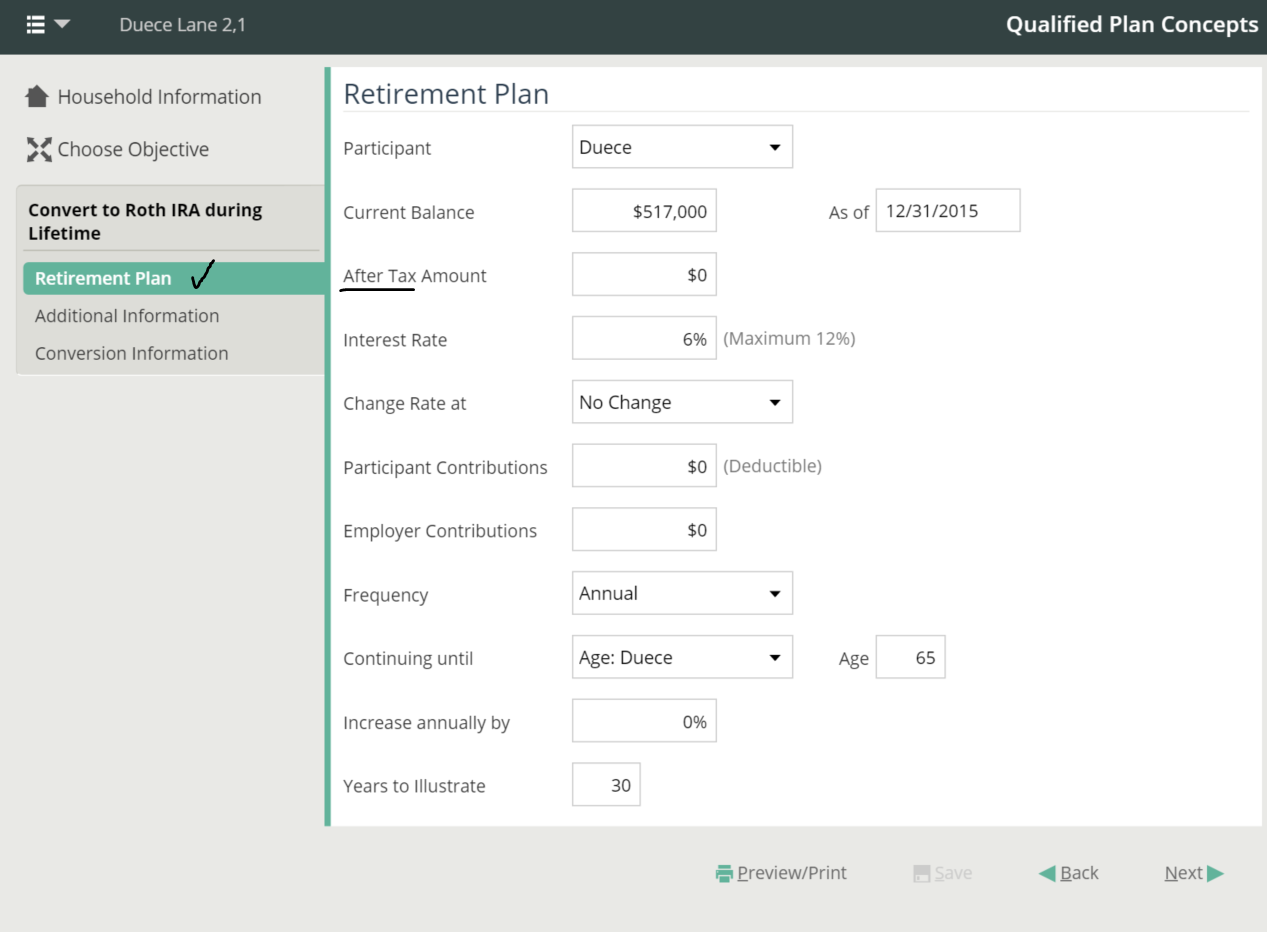

What goes in the ‘After Tax Amount’ tab in Qualified Plan Concepts (QPC)?

The ‘After Tax Amount’ tab is for the amount contributed to the qualified plan where the contribution was already taxed before going into the plan. Something like this would happen if your client has commingled qualified money, perhaps a mixture of pretax employee/employer contributions from a hired position and after tax contributions as a self employed individual. This all of course would have an impact on how the distributions will be taxed coming out.