Adding Existing Life insurance in FNA

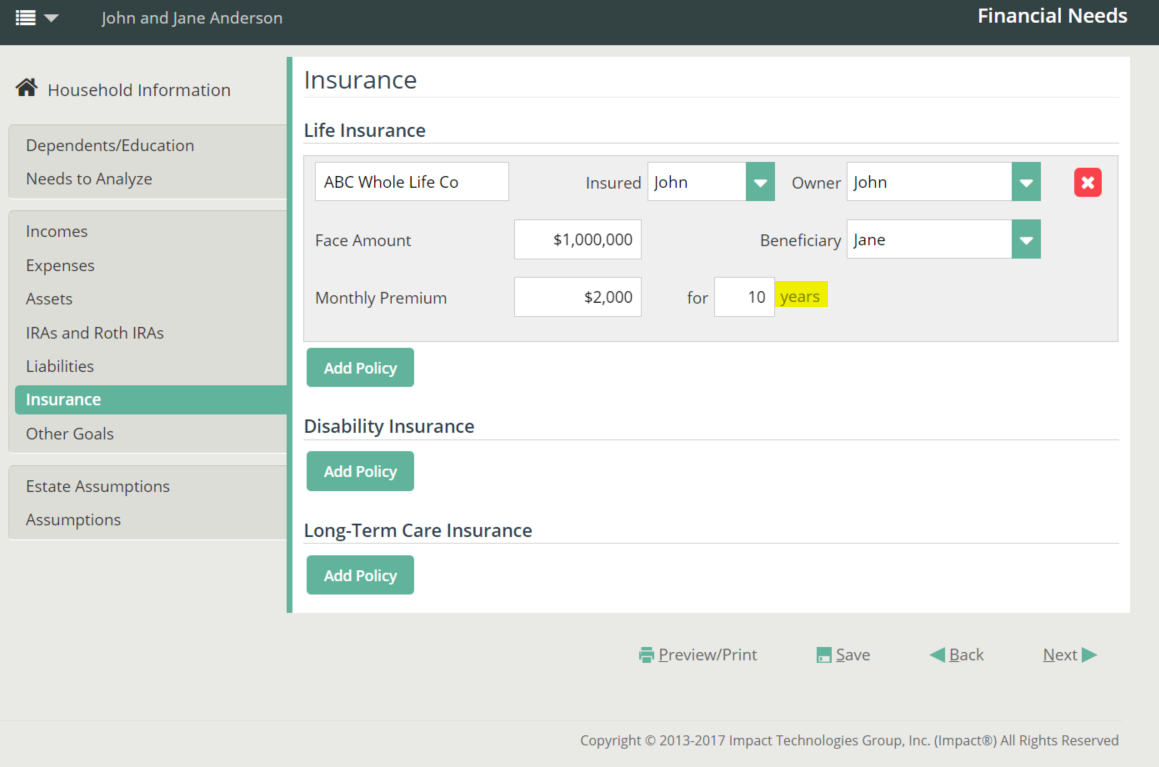

It’s important to add your client’s existing life insurance in Financial Needs Analysis (FNA) so the final calculation can exclude the amount of the death benefit currently in place. For the Survivor Needs module, the actual death event happens today. That being the said, it’s important to have at least 1 year in the years tab so the policy will appear to be in place at time of death (happens immediately). If the years tab has 0 in it, there won’t be a death benefit available (it’s like it doesn’t exist). If your client has a paid up policy, you can keep the monthly premium $0 (default). The death benefit payout will always appear in the ‘Net Worth’ column in the ledger.

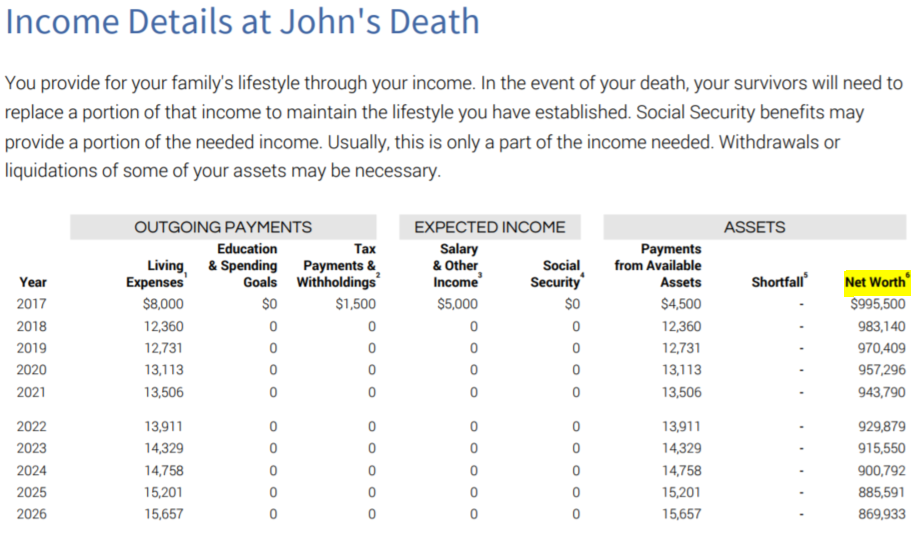

Locate the death benefit balance in the Net Worth column. In the example below, there is a million dollar policy in place with a $1,000 monthly expense. The remaining expenses for the year is taken out first showing the remaining balance