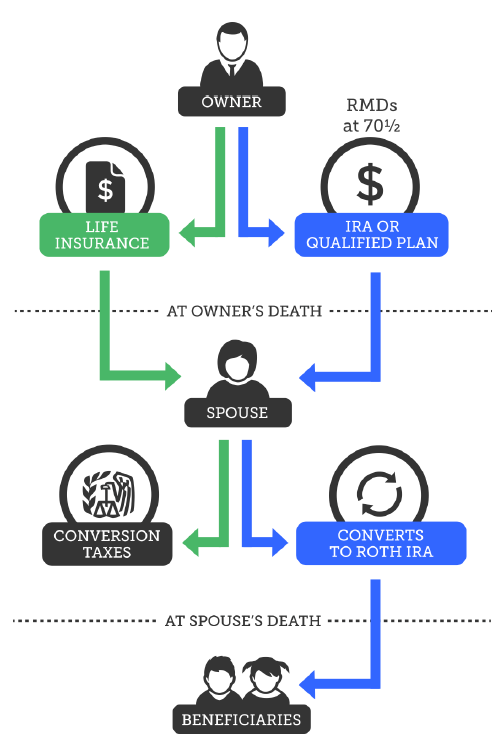

Using life insurance to pay for Roth IRA conversion at 1st spouse’s death

Most people love the benefits of a Roth IRA but do not like the idea of paying the upfront tax on the conversion. If you have a client who doesn’t need the income from their qualified plan, doesn’t want to pay taxes upfront for conversion now, and who wants their heirs have access to tax-free cash, consider showing them the ‘Convert to a Roth IRA at Death’ module.

The Concept:

Steps to show this concept:

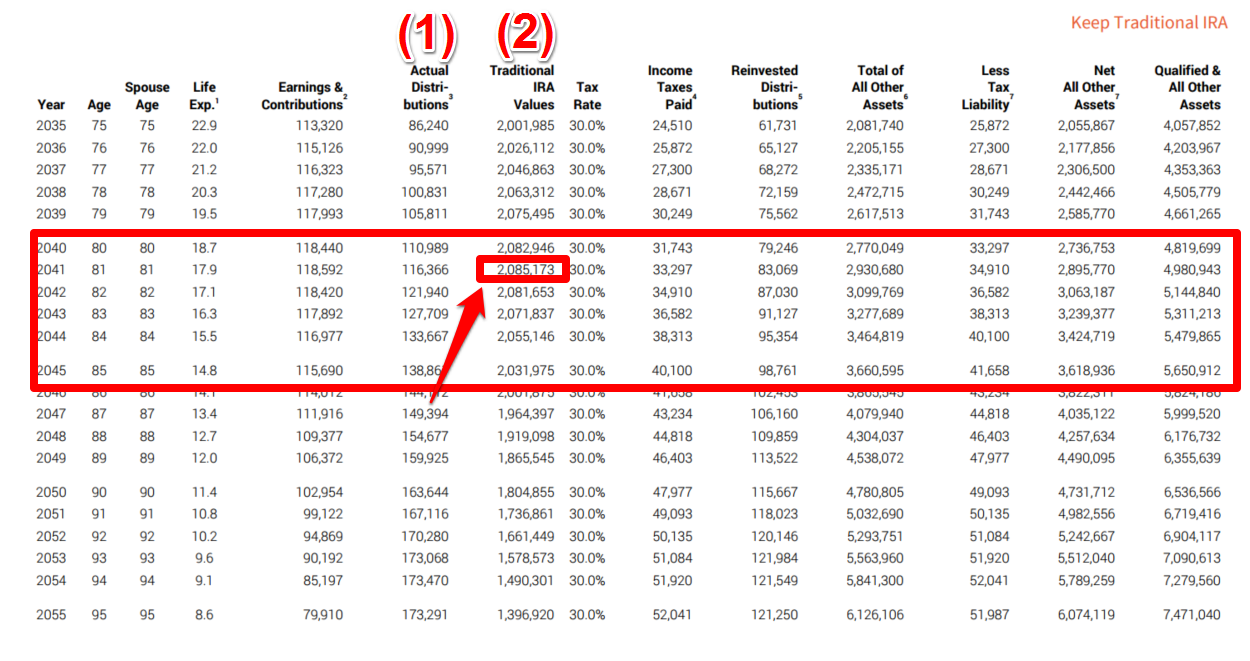

(1) Show your client what their RMD’s will look like while they are still living.

(2) Decide the estimated death year and look at the total estimated balance of the retirement plan at that time (30% to 40% of this amount is a good starting point for the amount of life insurance needed).

*Steps 1 and 2 can be completed by simply entering the Household Information section and the Retirement Plan section. Then ‘Print’.

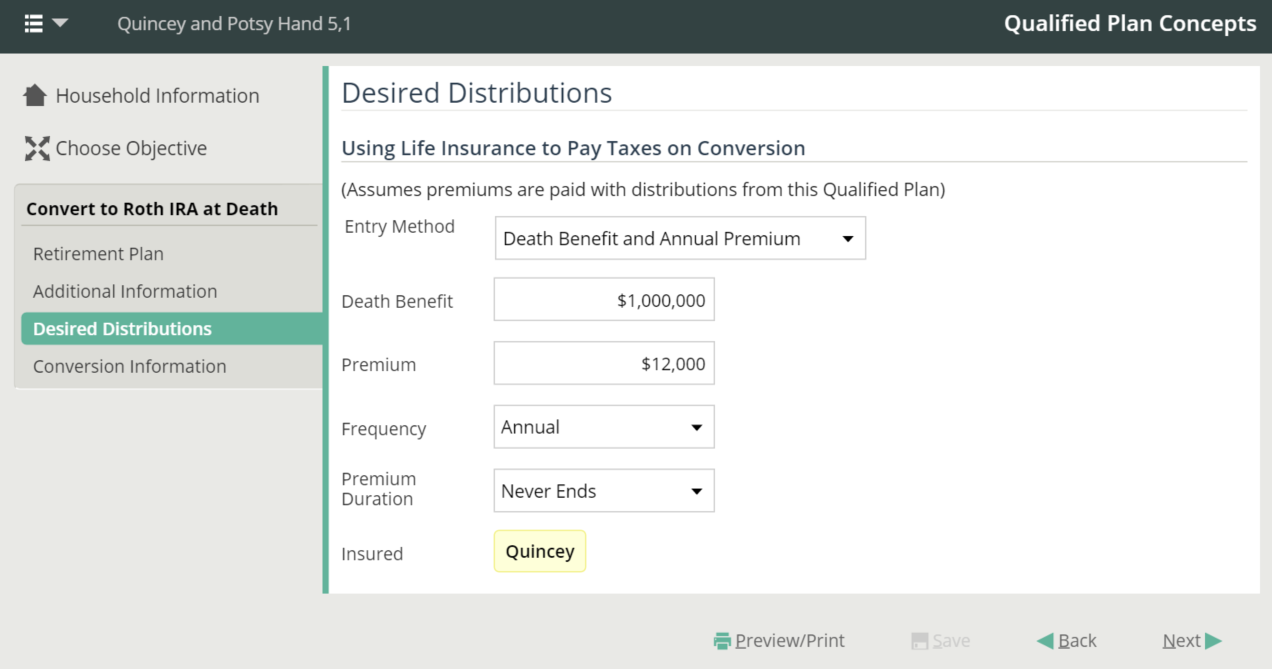

(3) Select ‘Desired Distribution’ in QPC to input the life insurance information. Input the proposed life insurance information.

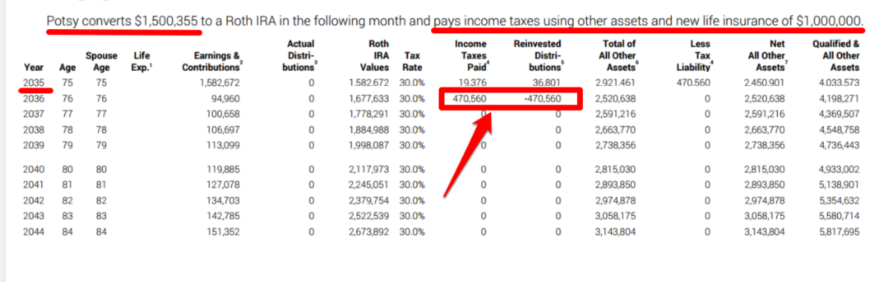

(4) Show the death-year and the taxes that are getting paid by death proceeds.

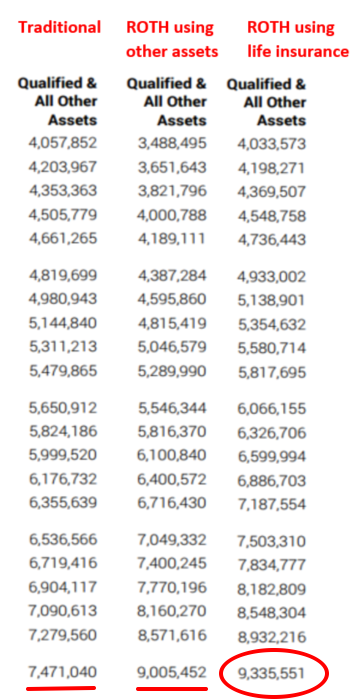

(5) Compare ‘Qualified and Other Assets’ column balance for all three scenarios which include Keep Traditional IRA, Convert to a Roth IRA Using Other Assets to Pay Taxes, and Convert to a ROTH IRA Using Life Insurance to Pay Taxes. This column shows the importance of keeping taxes low and allowing as much qualified money to grow tax deferred for as long as possible. Convert to a ROTH IRA Using Life Insurance to Pay Taxes will show as a higher total amount than the other two scenarios.