Use CFD to determine your client’s pension payout options

Does your client have a choice in how their pension gets paid out? Follow the steps in the PDF to determine which of the payout options is best!

Those who are fortunate enough to be entitled to a pension often times have different Survivor payout options to consider. The biggest ‘what if’ when analyzing the best option for your client(s) is their life expectancy age. Having a discussion about life expectancy, health issues, and family longevity, is crucial to setting this assumption. This assumption should absolutely be determined by your client (CFD defaults to the SSA life expectancy tables).

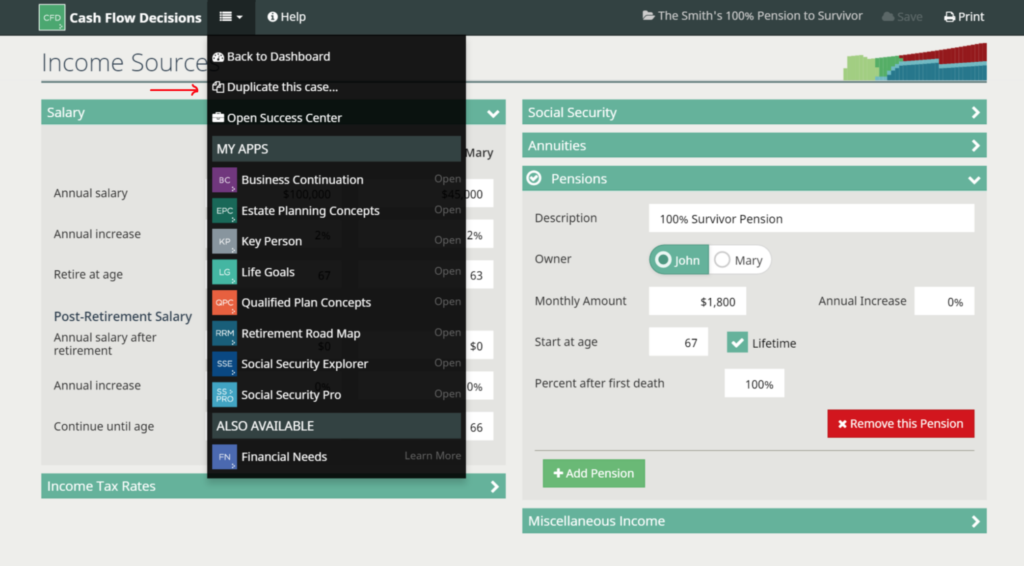

CFD can quickly show you and your client the pension payout option to take that provides the best cash flow results. You’ll need to enter the different pension payout options, one-by-one. You can do this by taking advantage of ‘Duplicate this case…’ feature in PlanFacts.

Using the Duplicate Case feature

The duplicate case feature saves you time and helps ensure that only the pension variables are changed, nothing else. The first case that’s created will take the longest because you will need to enter all information for the client. After you’re done inputting the first case, save it (and name it).

In dropdown menu in the top toolbar, select “Duplicate this case…” to make a copy of your first case and change only the pension variables. Make sure to save it (and name it).

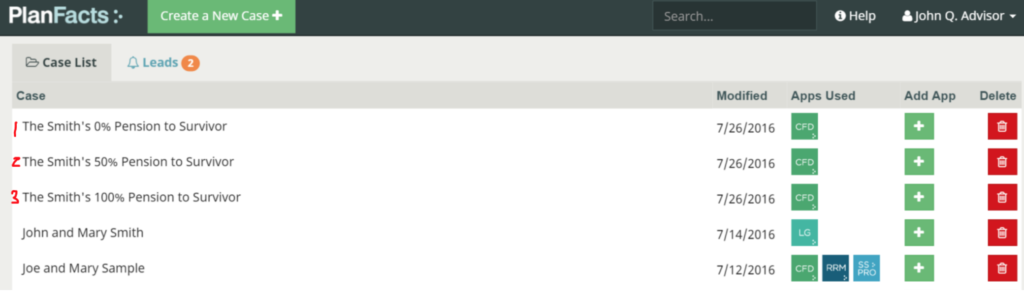

Repeat the “Duplicate this case…” steps until you have a case saved and named for each set of pension variables. After your cases have all been duplicated and adjusted, you should see them on your dashboard (in this sample there are 3 cases…0%, 50%, and 100% to Survivor).

Sample Case

In this sample case, the pension is $2,000, and belongs to the Husband. He’s also offered two other options: allowing 50% to continue to the survivor or 100% to continue to the survivor (each have a price to pay for the continuation of payments).

- Pension: $2,000

- Owner: Husband

- 0% to survivor= $2,000 Pension

- 50% to survivor with 6% reduction= $1,880 Pension

- 100% to survivor with 10% reduction= $1,800 Pension

How do you know which option is best? Let CFD determine that!

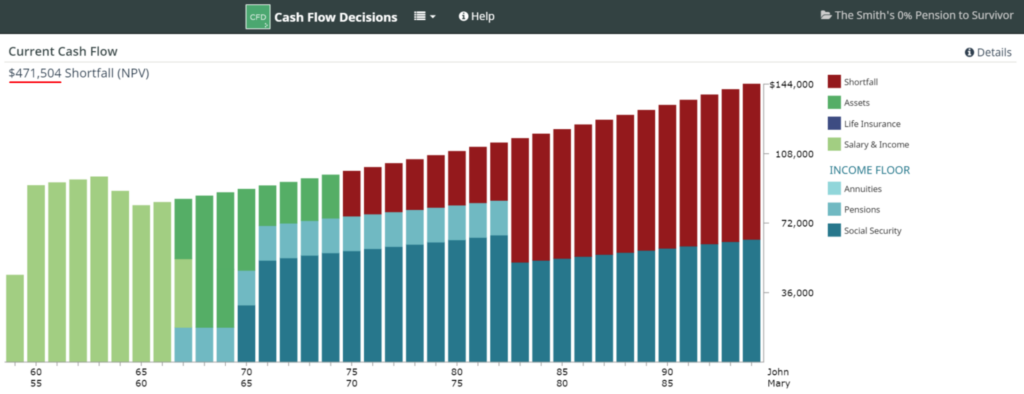

Option 1: 0% to survivor ($2000 pension)

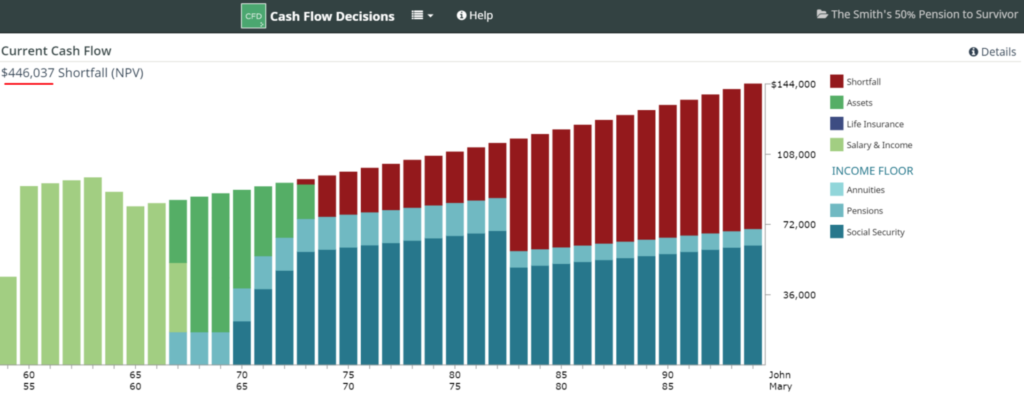

Option 2: 50% to survivor with 6% reduction ($1,880 pension)

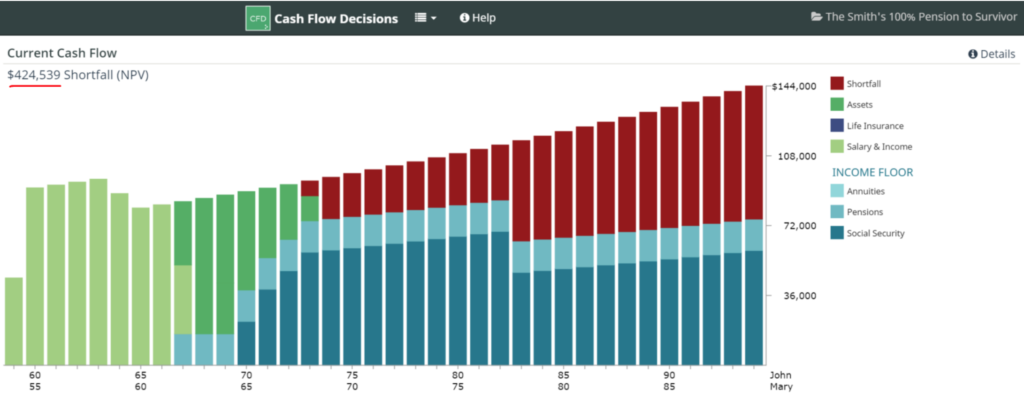

Option 2: 100% to survivor with 10% reduction ($1800 pension)

Case Results

In this case, taking a 10% reduction of the original pension bringing the pension amount for the Husband down from $2,000 to $1,800 and providing all 100% of it to the Survivor is best. This results in the lowest shortfall.