The Flooring Approach (Guaranteed Income)

If we all retired during a bull market and continued to ride that market far into retirement, we wouldn’t have to worry about things like bond laddering and annuities. Our money would continue to grow most likely at a pace far greater than the rate of which we are taking money out. Retirement would be just peachy! But are your clients ready to gamble to see if they’re going to ride a bull market into retirement? Let’s hope not!

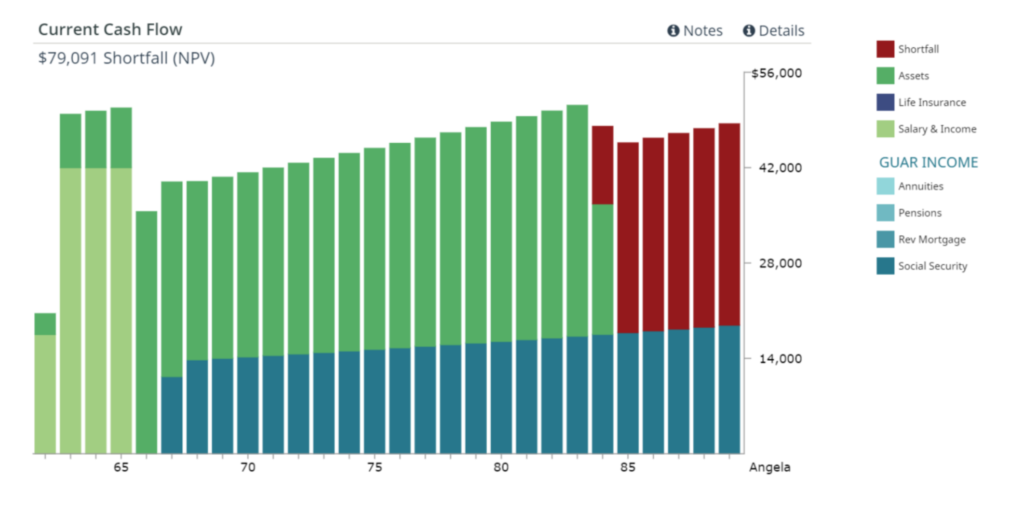

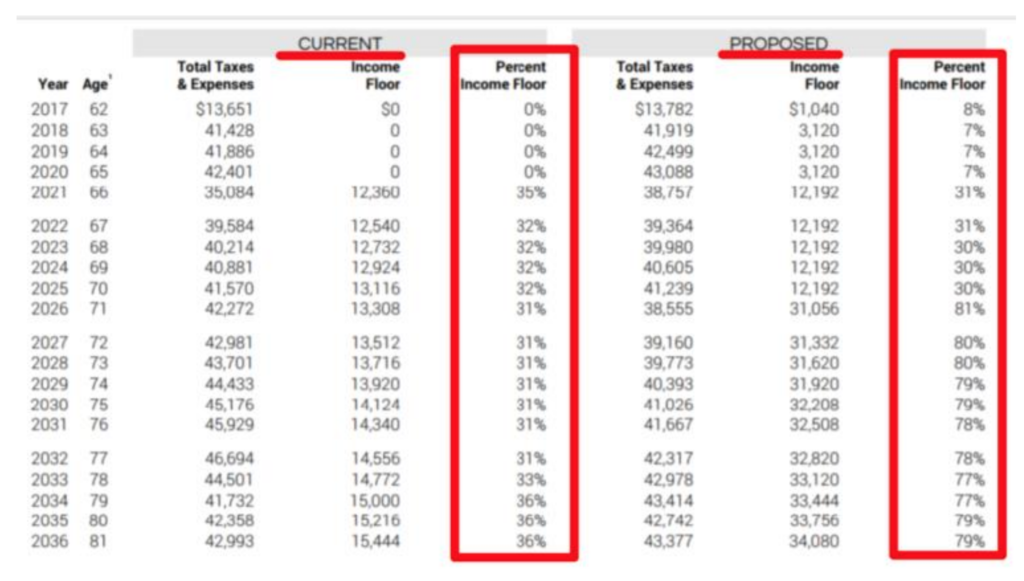

Building an income floor is a way to protect against the down-turns in our economy. It allows clients to feel confident that if something really hits the fan at or around retirement age, their expenses will be largely taken care of by guaranteed income (floor money). Below is a snapshot of Impact’s Cash Flow Decisions output.

Really, a $79,091 shortfall isn’t terrible, especially when we are projecting out 30 years. If Angela worked two more years the shortfall would nearly disappear. Or, if we dropped the post-retirement expenses down 10% from her current expenses the shortfall would disappear. Let’s just say a $79,091 shortfall in a 30 year projection isn’t that much! But, this is all assuming a composite, comfortable, non-turbulent rate of return now and throughout retirement (net 4% now, 2% in retirement).

What do you think happens if Angela willfully retires or is forced to retire in a bad market?

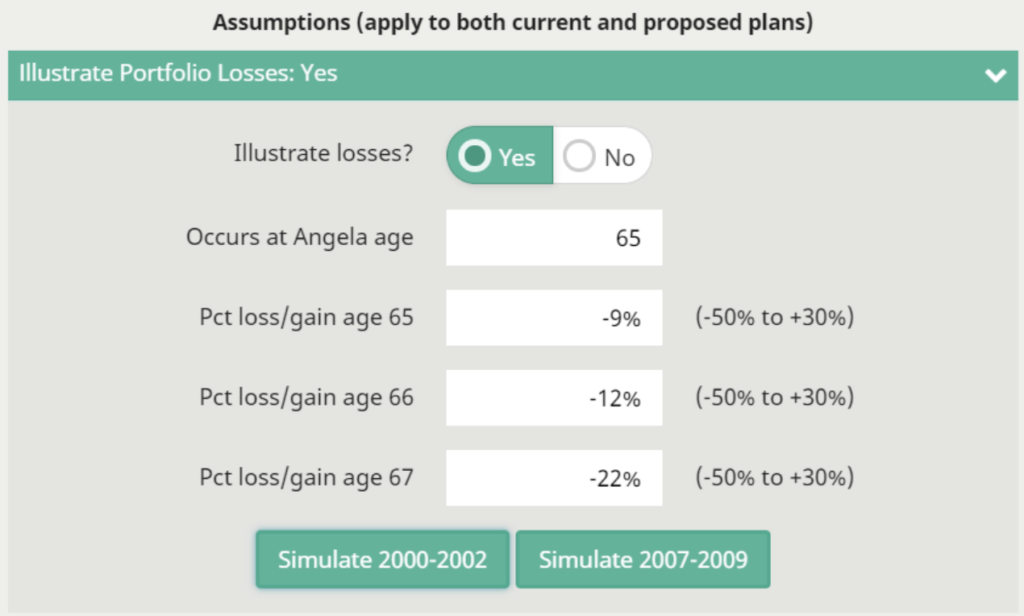

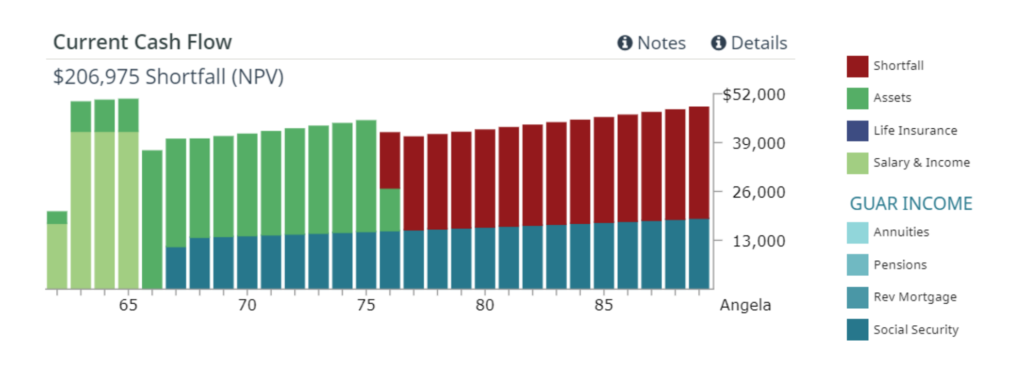

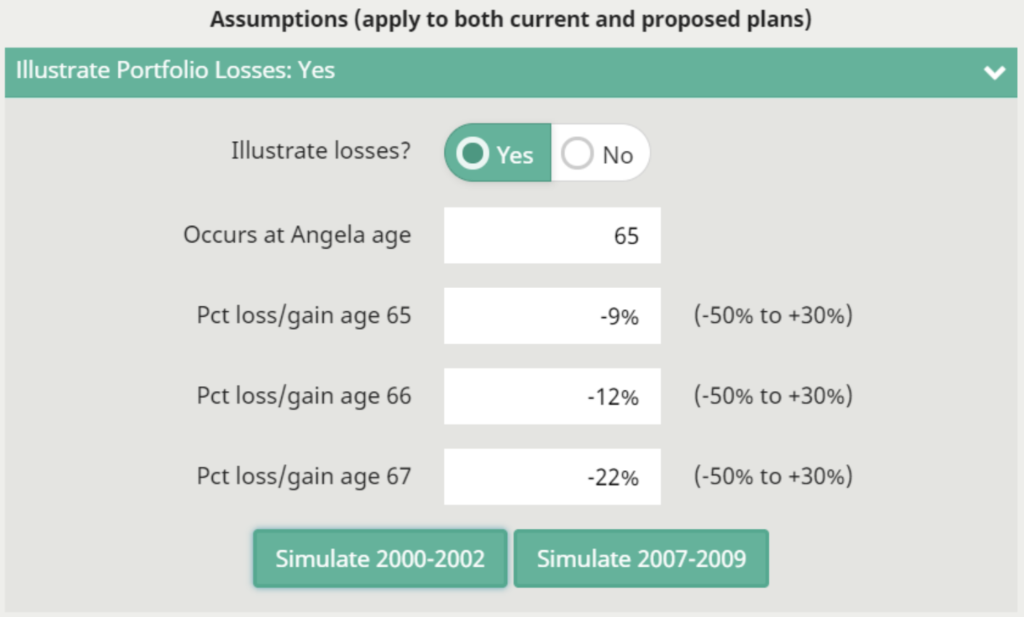

Remember 2000, 2001 and 2002? If 2000, 2001 and 2002 were to happen again near Angela’s retirement, things begin to look a little different.

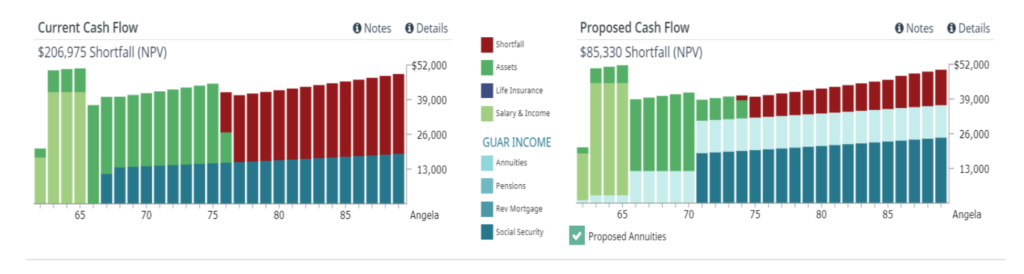

As you can see in the updated graph below, the retirement shortfall more than doubles, and by the time she is 77 years old the only thing she’ll have left is her Social Security income. That’s not good because she is healthy, extremely fit and plans on staying very active throughout retirement. Women in her family usually live to their late 80’s to mid 90’s.

There must be something that can be done to put Angela in a more offensive position and in charge of her retirement, besides telling her to work longer or reduce her monthly expenses, right?

Proposing Annuities

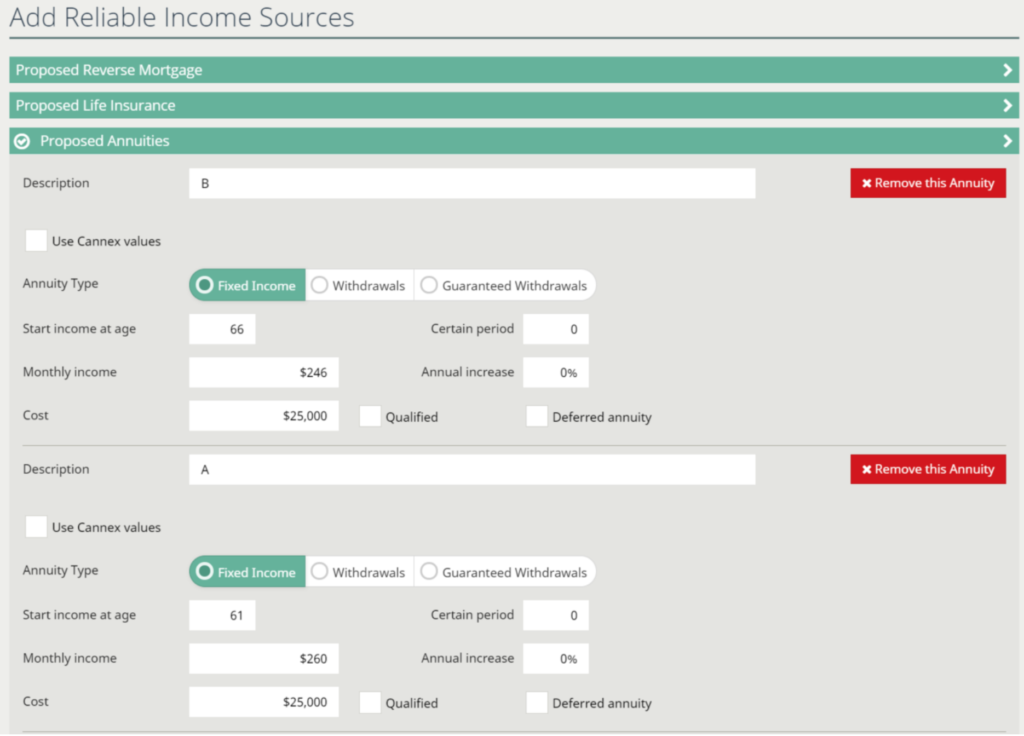

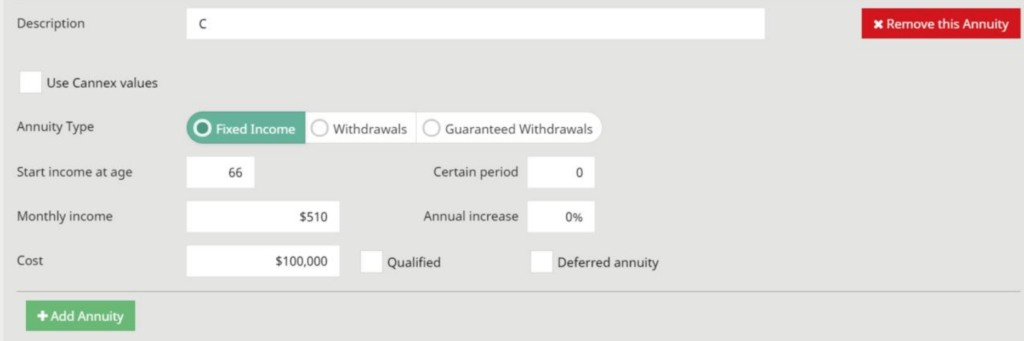

We’re going to propose an annuity in Cash Flor Decisions for Angela—in fact, we’re going to propose 3 annuities in total. One will begin now (age 61) and the other two will both start at age 66.

We’ll use the same stress test assumptions that were applied to the bar chart you saw earlier, but you can see in the comparison graphs below that there is a drastic difference in the retirement projections. The annuity looks like an excellent choice.

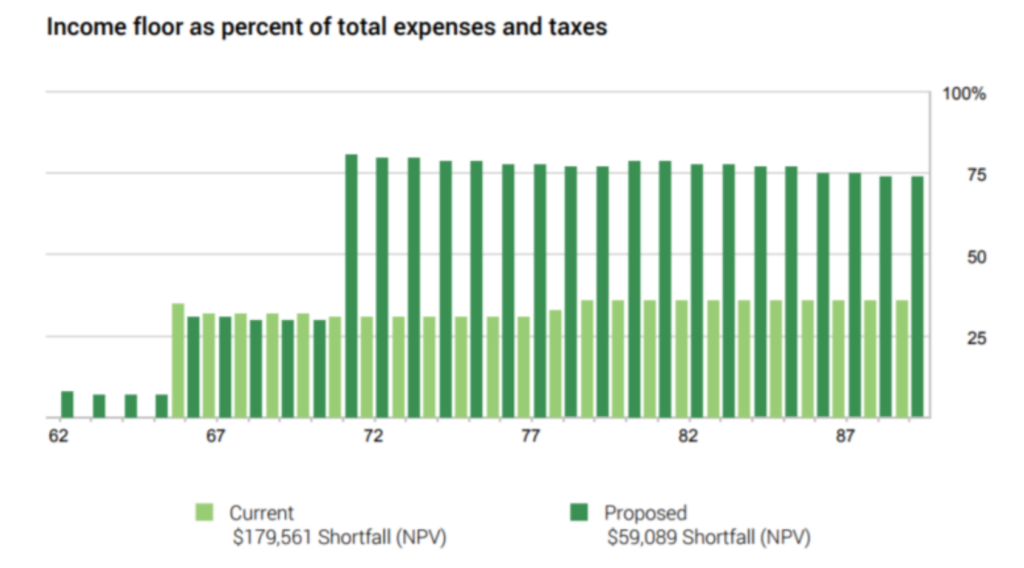

For those emphasizing income floor approaches, the new report pages in Cash Flow Decisions are going to be your showcase presentation pages, along with a ledger to complement the bar graph.

PlanFacts Cash Flow Decisions (CFD) allows you to fairly propose annuities for clients. CFD is also integrated with Cannex, which will allow the user to very easily import annuity quotes with just a simple click of the mouse.

You can stress test plans to show the value of building an income floor when markets become bearish, especially around the very sensitive time of retirement. Withdrawing money from a portfolio during a bad market is really hard on the portfolio. When you combine a couple bad years back to back with bad timing (at or close to beginning of retirement), it’s even more devastating.

Annuities are one way out of a few to help build an income floor. Income floors put client’s at ease, build it for them!