Ways to Fund a Buy-Sell

The owner recognizes the need for a Buy-Sell or business continuation agreement. How can it be funded? There are only three ways to fund a Buy-Sell:

- Cash

- Borrow

- Save

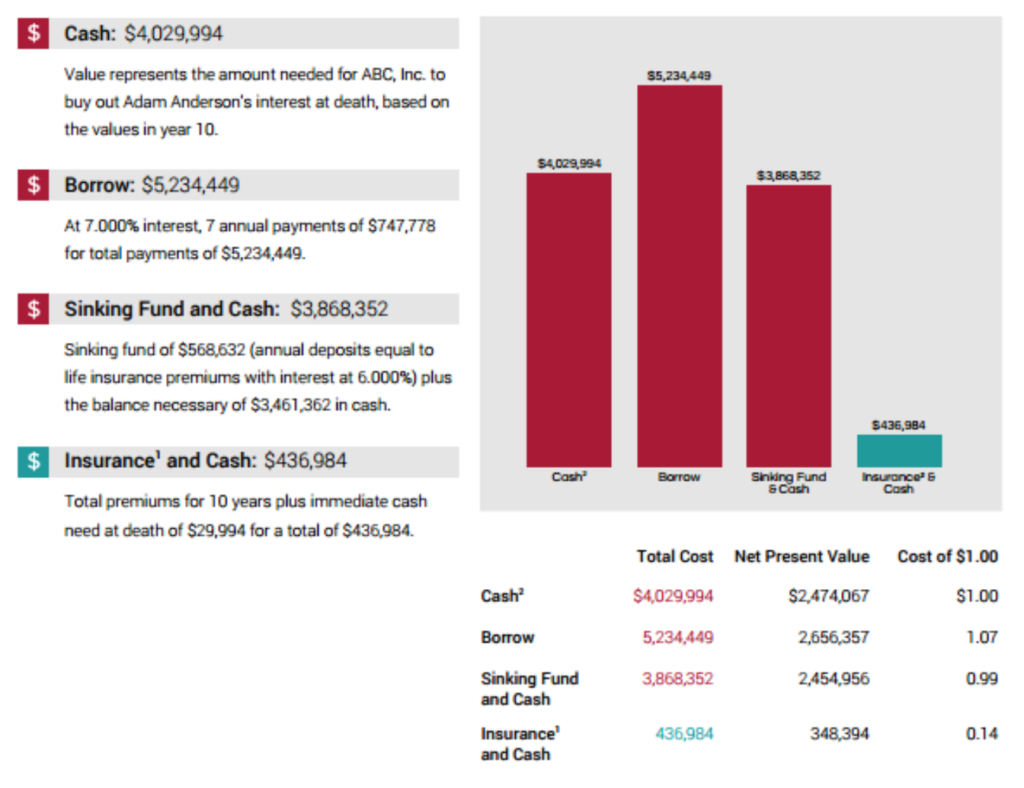

Cash is best, but the best way to have the cash needed at the precise time it is needed—the death of the owner—is life insurance. Let’s look at these options with an example as seen below. The owner’s interest is projected

to be worth $4,029,994 in 10 years, the assumed time of his death.

Cash: The amount of cash needed would be the full amount: $4,029,994.

Borrow: A load at just 7% to be paid back over 7 years would require annual payments of $747,778. These payments would seem even more difficult following the owner’s death. This option would cost a total of $5,234,449.

Savings: A sinking fund to use for this purpose was established with annual deposits equal to the life insurance premiums. If it earned 6% annually, it would only have $568,632 in ten years; therefore, requiring additional cash of $3,461,362 for a total cost of $3,868,352. (Many people believe that if the premiums were invested for a long enough period, that eventually they would out preform the life insurance. One has to live a very long time to make that possible.) The problem with a sinking fund is that you don’t know when it will be needed. You save too little and still need a lot of cash, or you save too much each year when those funds could be used for growing the business.

Life Insurance: Premiums are paid each year until the owner’s death. The death proceeds become available exactly when they are needed—the death of the owner. In this case, premiums of $40,699 were paid each year and $4,000,000, the face amount, was paid at death. Total cost would be the additional cash needed of $29,994 plus the sum of the premiums $406,990 or $436,984.