Comparing Funding Methods with Different Timing

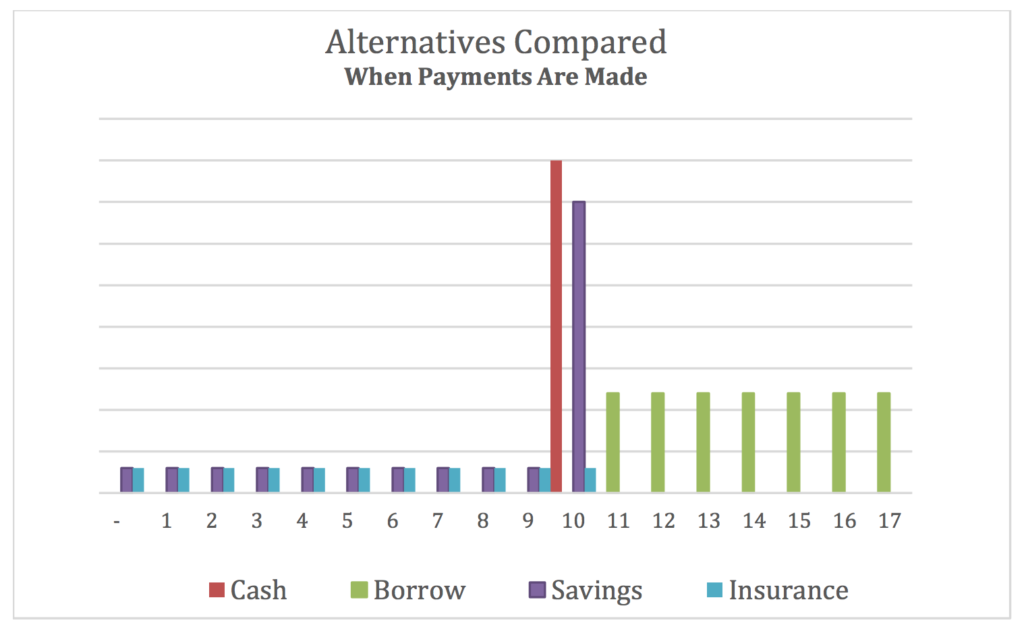

Comparing payment methods can be misleading because each of these amounts are due at different times. Cash is due in one payment 10 years from now. Borrowing is in seven annual payments with the last one 17 years from now. Savings is 10 annual payments starting now and a large payment in 10 years. Insurance is 10 annual payments starting now and a small payment in 10 years.

The best way to compare streams of money over different time periods is by comparing net present values. By comparing to the Cash alternative, each dollar of business interest cost $1.00 in today’s dollars. Borrowing cost $1.07 in today’s dollars, Savings cost $0.99 in today’s dollars, and Insurance cost $0.14 in today’s dollars. It’s really simple. Do you want to pay the equivalent of a dollar for dollar? Or, pay a little more than a dollar for dollar? Or, a little less than a dollar for dollar. Or do you want to pay a lot less than a dollar for dollar? Given the choice, I think we all like paying a lot less for each dollar of business interest.