How to determine the monthly amount of non-covered pension?

If you are unsure whether your client’s Social Security benefit will be reduced due to a non-covered defined benefit plan or defined contribution plan, please refer to Section (A) 1-4

If a lump-sum option was taken or will be taken, or if the amount being shown is not a monthly amount, or if payments are determined by the individual, you’ll need to calculate the monthly payment to determine the Social Security reduction.

- If the payment is already in a monthly form, make sure that it’s a gross amount before reductions

- Payments paid on anything other than monthly basis (excluding lump-sum)

- multiplying a weekly pension amount by 52 and then dividing by 12; or

- multiplying a bi-weekly pension amount by 26 and then dividing by 12; or

- dividing annual or semi-annual pension payments by 12 or 6 respectively

- When the individual can decide the payout, treat the pension as a lump-sum and follow the table below

- Lump sum payments previously, now or in the future

- May be in the form of a specific period or a ‘lifetime’ payment

- Generally the pension-paying entity will provide a prorated monthly amount. If they don’t use the table below

- Specific Period – Divide the lump sum by the number of months in the period specified by the pension-paying agency. See RS 00605.360C.5.a. for when WEP application ends.

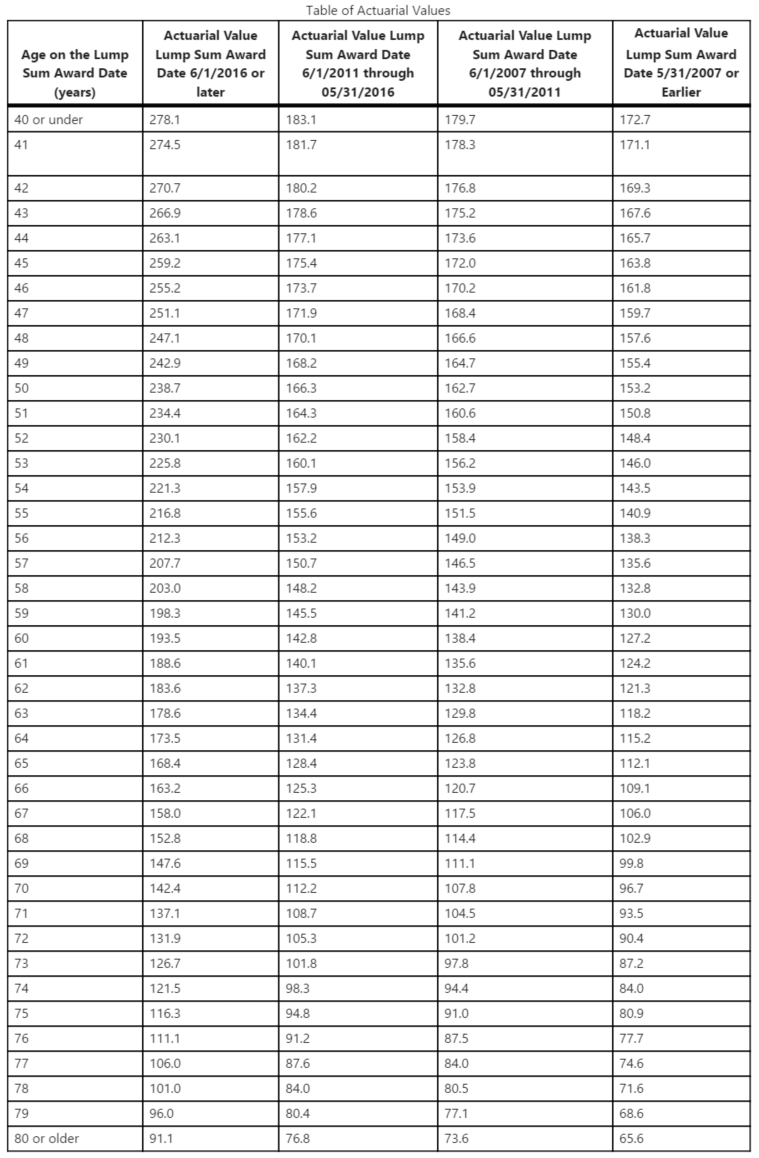

- Lifetime or Unspecified Period – Divide the pension lump sum amount by the appropriate actuarial value in the table that corresponds to the worker’s age on the date of the lump sum award