How to enter a Qualified Longevity Annuity Contract (QLAC) in CFD?

In July of 2014, Qualified Longevity Annuity Contracts (QLACs) became available for purchase within an IRA or employer-provided retirement plans. The ruling allows the smaller 25% or $125,000 to be transferred to a QLAC. The ruling also defers the required minimum distributions for the portion placed in the QLAC until the annuity payments begin.

Consider this case study

John and Mary are both 60. John has an IRA with $500,000 which means he could purchase a QLAC for up to $125,000. But should he?

A joint life annuity with payments starting at age 85 will provide approximately $3852 per month for the rest of their lives. How does this affect their cashflow?

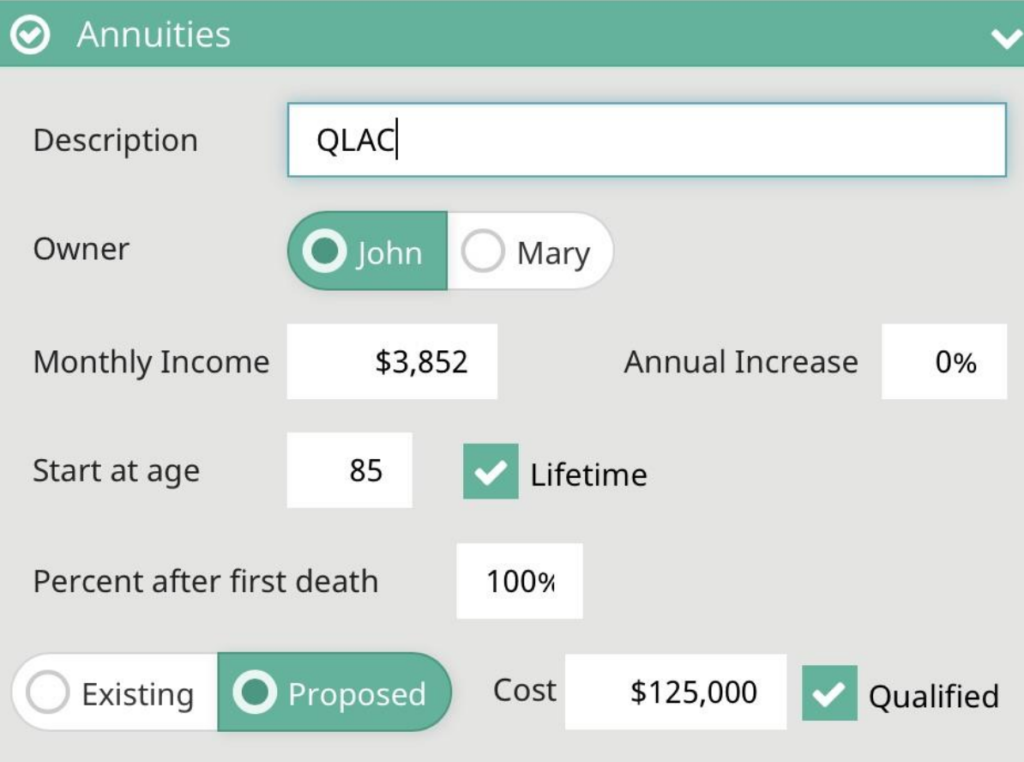

First, on the Income sources screen, enter the annuity information. John will be the owner, since we are using his IRA to purchase the annuity. Enter the monthly income and check the Lifetime box. Since this is a joint life annuity, enter 100% after first death. Select ‘Proposed’ and enter $125,000 as the Cost. Be sure to check ‘Qualified’ to use John’s IRA to purchase the QLAC.

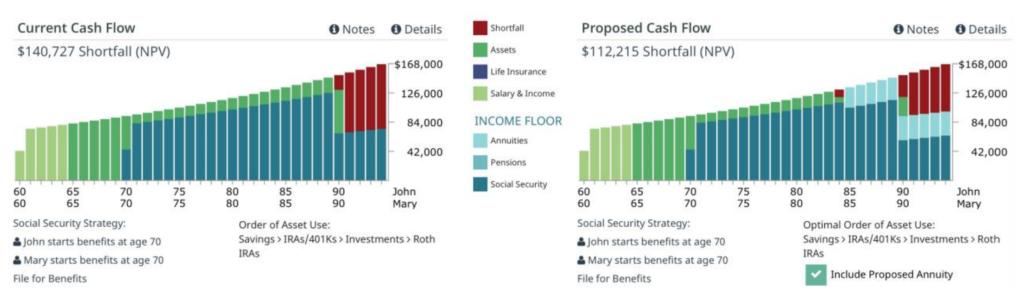

Let’s look at the results, assuming John lives to age 90 and Mary, 95.

The shortfall has been reduced plus the Income Floor has been enhanced in the later years providing 100% of their needs from ages 85 to 90. A life insurance policy could also be used to fill in the needs after John dies.

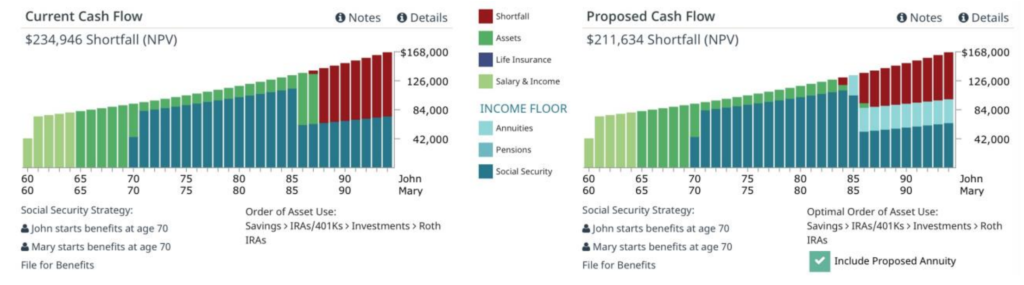

Here are the results if John should die earlier, at age 86, and the annuity income continues for Mary.

If John should die before income starts, many contracts offer a death benefit or return of premiums to the survivor.